A Simple Guide to CalHFA Programs for First-Time Homebuyers

CalHFA Loan Programs: A Simple Guide for California Homebuyers

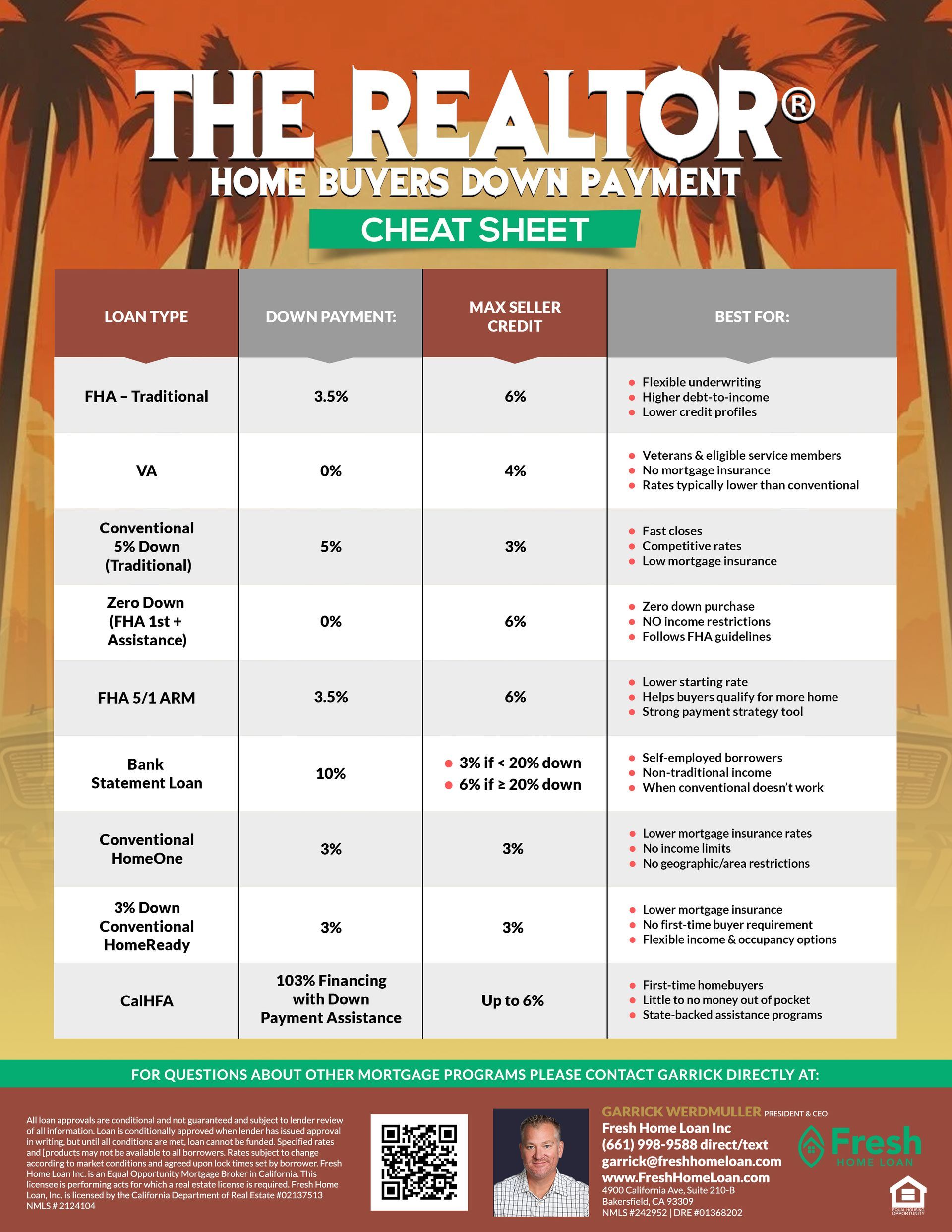

Buying a home in California can feel overwhelming—especially when it comes to saving for a down payment and closing costs. That’s where CalHFA (California Housing Finance Agency) comes in.

CalHFA offers state-backed mortgage programs and down payment assistance designed to help first-time and moderate-income buyers become homeowners. At Fresh Home Loan, Inc., we help buyers and real estate agents understand and use these programs every day.

What Is CalHFA?

CalHFA is a California state agency that supports homeownership by offering:

- Competitive first mortgage programs

- Down payment and closing cost assistance

- Education for first-time buyers

CalHFA does not lend directly to consumers. All CalHFA loans must be originated through an approved lender, like Fresh Home Loan, Inc.

Who Is Considered a First-Time Homebuyer?

For CalHFA programs, a first-time homebuyer is someone who:

- Has

not owned a home in the last 3 years, and

- Will live in the property as their

primary residence

All borrowers on the loan must meet this definition when using down payment assistance programs like MyHome.

MyHome Assistance Program: Help With Down Payment & Closing Costs

The MyHome Assistance Program is one of CalHFA’s most popular options.

How MyHome Works

- It is a

subordinate (second) loan

- Used for

down payment and/or closing costs

- No monthly payments

- Payment is deferred until:

- The home is sold

- The first mortgage is refinanced

- The first mortgage is paid off

How Much Assistance Is Available?

- FHA / CalPLUS FHA loans: up to

3.5% of the purchase price

- Conventional, VA, or USDA loans: up to

3% of the purchase price

This assistance can significantly reduce the amount of cash needed to close.

Common CalHFA First Mortgage Options

1) CalHFA Conventional

- 30-year fixed conventional loan

- Can be combined with MyHome

- Ideal for buyers with solid credit

2) CalPLUS Conventional

- Includes additional assistance for

closing costs

- Always paired with MyHome

- Great option for buyers who want to minimize out-of-pocket costs

3) CalPLUS Access

- Designed for lower-income buyers

- Offers additional assistance on top of MyHome

- Must be used with MyHome

4) Dream For All (Special Program)

- For

first-time, first-generation buyers

- Includes shared appreciation assistance

- Limited availability and special rules apply

Homebuyer Education Is Required

CalHFA requires at least one occupying borrower to complete a homebuyer education course.

This can be done:

- Online

- In person or virtually

The goal is to help buyers understand the responsibilities of homeownership and feel confident throughout the process.

Important Things to Know

- The home must be owner-occupied

- Non-occupant co-borrowers or co-signers are

not allowed

- Income limits apply and vary by county

- Minimum credit scores typically start around

660–680

- Single-family homes, condos, and some manufactured homes are allowed

Why Work With Fresh Home Loan, Inc.?

CalHFA loans have specific rules, layering requirements, and income limits. Working with an experienced lender makes all the difference.

At Fresh Home Loan, Inc., we:

- Determine which CalHFA programs you qualify for

- Structure the loan correctly from the start

- Coordinate with real estate agents for smooth closings

- Guide buyers step-by-step through the process

Learn more about CalHFA homebuyer programs at:

https://www.calhfa.ca.gov/

📲 Thinking about buying your first home in California?

👉 Contact us today to explore your CalHFA options.

Garrick Werdmuller

President & CEO

Fresh Home Loan Inc.

📱 510-282-5456

📩 garrick@freshhomeloan.com

🌐 https://www.freshhomeloan.com

DRE 01368202 | NMLS 242952

#CalHFA #HomeOwnership #FirstTimeHomebuyer #DownPaymentAssistance #CaliforniaHomes #FreshHomeLoan #AffordableHousing #MortgageTips #ConventionalLoans #RealEstate