Unlocking California Homeownership: Down Payment Assistance Programs in California

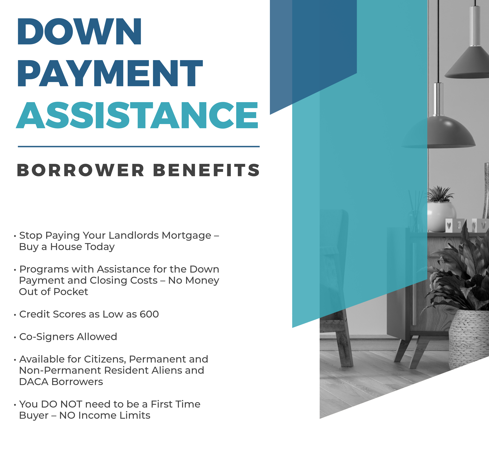

For many aspiring homeowners, saving for a down payment can be a significant challenge. Fortunately, California offers a variety of Down Payment Assistance (DPA) programs designed to bridge the gap and make homeownership more accessible. Whether you’re a first-time buyer or just need a little help, these programs can be a game changer.

What is Down Payment Assistance?

Down Payment Assistance programs provide financial support to cover a portion—or even all—of your down payment and closing costs. These programs come in several forms:]

- Grants: Free money that does not need to be repaid.

- Forgivable Loans: Loans that are forgiven if certain conditions are met.

- Low-Interest Loans: Loans with flexible repayment terms to ease the financial burden.

Special Wholesale Options: Fresh Home Loan Inc., DPA Products

Fresh Home Loan Inc. offers a suite of Down Payment Assistance (DPA) products tailored to meet the needs of FHA, USDA, and conventional borrowers. These programs are designed to make homeownership more accessible by reducing upfront costs and providing flexible financing options. Unlike many state and local DPA programs these have NO INCOME RESTRICTIONS! Here’s an overview of their standout offerings:

1. BOOST DPA (FHA & USDA)

- Assistance: Provides 3.5%-5% of the loan amount.

- Usage: Can be used for both down payments and closing costs.

- Eligibility: Ideal for FHA and USDA borrowers looking to minimize upfront expenses and make their home purchase more attainable.

2. ELEVATE GRANT (FHA & Conventional)

- Assistance: Offers up to 3.5% of the loan amount as a grant.

- Key Benefit: No repayment required, making this a true financial gift for eligible borrowers.

- Applicable Loans: Available for FHA and conventional loan programs, catering to a broad range of buyers.

3. AURORA DPA (FHA)

- Assistance: Provides options for forgivable or repayable assistance.

- Features:Forgivable Loans: Waive repayment if specific conditions are met, such as staying in the home for a set period.

- RepayableLoans: Offer structured, borrower-friendly repayment terms.

- Best For: FHA borrowers seeking tailored solutions to fit their unique financial situations.

No Income Limitations: A Game ChangerOne of the standout features of these programs is the lack of income limitations. Unlike many other Down Payment Assistance programs, Orion Lending’s DPA options are available to a wide range of borrowers, regardless of income level. This opens the door to homeownership for more buyers, whether they’re moderate-income earners or professionals with higher earnings seeking affordable solutions.

Why Choose Fresh Home Loan Inc. DPA Products?

- Broad Accessibility: With no income restrictions, these programs are suitable for a diverse group of borrowers.

- Flexible Assistance Options: Tailored programs to fit different financial needs and goals.

- Comprehensive Support: Covers down payment, closing costs, and more to ease the path to homeownership.

- Expertise You Can Trust: Backed by Orion Lending’s commitment to delivering innovative and borrower-friendly solutions

Other options in California are available as well. These are designed for first time home buyers. There are many DPA programs in California. Here are the three more common:

The Top 3 Down Payment Assistance Programs in California

1. California Dream For All Shared Appreciation Loan

- Assistance: Provides up to 20% of the home purchase price.

- Repayment Structure: Tied to the home’s appreciation when sold or refinanced.

- Eligibility: Specifically for first-time buyers, with at least one borrower required to be a first-generation homeowner.

2. CalHFA MyHome Assistance Program

- Assistance: Offers a deferred-payment junior loan of up to 3.5% of the purchase price or appraised value.

- Usage: Can be applied toward down payments or closing costs.

- Eligibility: Ideal for first-time buyers meeting income and sales price limits.

3. Golden State Finance Authority (GSFA) Platinum Program

- Assistance: Provides up to 5.5% of the loan amount, either as a gift or a 0% interest loan.

- Target Audience: Available to both first-time and repeat homebuyers.

- Additional Benefits: Flexible underwriting compatible with various loan types.

Benefits of Down Payment Assistance

- Lower Entry Barriers: Reduces upfront costs, making homeownership more accessible.

- Accelerated Homeownership: Allows buyers to enter the market sooner.

- Enhanced Buying Power: Increases purchasing options, even in competitive markets.

Who Qualifies for DPA Programs?

While eligibility requirements differ by program, they often include:

- First-Time Buyer Status: Defined as not owning a home in the last three years.

- Income Limits: Based on area median income (AMI).

- Creditworthiness: Minimum credit scores typically range from 580 to 640.

- Homebuyer Education: Completion of a HUD-approved course is often required.

How to Apply

- Fill Out the Application and Get Pre Approved: https://freshhomeloan.com/apply-now/

- Explore State and Local Options: Programs like CalHFA and GSFA offer diverse and robust support.

- Seek Expert Guidance: A mortgage broker or agent can simplify the process and match you with the best option.

Take the Next Step!

California’s Down Payment Assistance programs are here to help make your dream of homeownership a reality. Contact me today for personalized guidance and program details.

For more information contact Garrick Werdmuller: https://freshhomeloan.com/schedule-a-meeting/

Garrick Werdmuller

garrick@freshhomeloan.com

1151 Harbor Bay Parkway Suite 136

Alameda CA 94502

(510) 282-5456

All loan approvals are conditional and not guaranteed and subject to lender review of all information. Loan is conditionally approved when lender has issued approval in writing, but until all conditions are met, loan cannot be funded. Specified rates and [products may not be available to all borrowers. Rates subject to change according to market conditions and agreed upon lock times set by borrower. Fresh Home Loan Inc. is an Equal Opportunity Mortgage Broker in California. This licensee is performing acts for which a real estate license is required. Fresh Home Loan, Inc. is licensed by the California Department of Real Estate #02137513 NMLS # 2124104

#Mortgage #RealEstateInvesting #PropertyInvestment #DelayedFinancing #CashOutRefinance #RealEstateFinance #InvestorFinancing #FlexibleFinancing #FirstTimeHomeBuyer #RealEstateInvestors #FreshHomeLoan #CaliforniaRealEstate